James Buchanan as a Health Economist

Mark V. Pauly

Wharton School

University of Pennsylvania

August 1999

Introduction

The broad and deep themes of the role of the individual relative to the state, and the proper long-term rules for the conduct of society were James Buchanan’s primary areas of interest. He did not write much on the popular events of the day (with the notable exception of Academia in Anarchy); he is not a "policy analyst" although he certainly has provided one of the definitive models for the analysis of collective policy. However, one other area of application which did tempt his interest—with that interest responsible for much of the direction of my own career—was medical care. He was the sole author on two essays on medical care, and co-authored a third (with C.M. Lindsay, The Organization and Financing of Medical Care in the United States.) In this note I want to comment on the ideas expressed in the two singly-authored essays, placing them in the context of the large and growing body of research on medical economics, while at the same time spotlighting some insights so far neglected which could be discovered with profit by medical economists, and perhaps by the economics profession as a while. Along the way I will mention the tension that any economist of a reflective nature, of which James Buchanan was the example par excellence, feels which confronting an applied and politically charged issue.

The two essays were written nearly fifteen years apart. One was a monograph for the Institute of Economic Affairs, published in 1965, on The Inconsistencies of the National Health Service. I will give this essay great credit for stimulating my thinking on the phenomenon which I discovered in research for my thesis was labeled "moral hazard," but I will agree that its insights about collective versus market choice as a way to deal with moral hazard have yet to be fully realized.

The other essay was written for a conference in 1989, though not published until 1994, and dealt with what is in fact the root cause of the growth in real health care costs: the adoption of technology that is cost-incurring but quality improving1. The fundamental premise of this paper, appropriate for the time it was written, is that the apparently inexorable growth in cast and spending needs to be reined in. It is, I think, it is far to say, a "nervous" paper, as Buchanan tries to reconcile the apparently market-driven rise in cost with his intuition that something has to be done, using collective action if necessary, to stop this process. For much the same reasons, it is a paper I find uncomfortable on first reading, but one that (I will argue) benefits from reflection on the theory and contrast after the fact, about the political and economic developments in medical services financing in the 1990s.

Inconsistencies and Consistencies.

Buchanan’s view was that the free care provided by the National Health Service in the United Kingdom caused people to seek care relative to two benchmarks. On the one hand, they sought care more frequently than they would have done if they had to pay for it out of pocket. In itself, this encouragement to the use of supposedly beneficial care would not have been regarded as a bad thing, since presumably the reason for enacting the NHS was to encourage people in using car that they formerly eschewed. The paradox was that, if such a motive (presumably related to what might be termed "altruistic externalities") was behind the creation of the NHS, why were voters then unwilling to support a budget large enough to satisfy all demand at a zero price? Buchanan’s answer was that, even if the price at the point of use was zero, the tax price for expanding the budget to a level consistent with that demand was definitely not zero; he hypothesized that, at some point, the marginal benefit from spending more would be judged by taxpayers as of less value than the marginal (opportunity) costs of the taxes they would have had to pay. As a result, taxpayers would choose a budget so limited that demand at a zero price could not be satisfied. The waiting lists, antiquated facilities, and arbitrary limits on care which characterize the NHS are to be expected.

At one level, this "inconsistency" in the NHS is the same kind of inconsistency, apparent in many forms of human behavior, that has been labeled "moral hazard." People are induced to change their behavior by insurance or other devices that reduce risk, and the resulting additional costs may be viewed as a sufficient setting of this behavior not as disembodied (or even specifically game-theoretic) individual or insurance-firm behavior but rather placing it explicitly in the context of collective choice. Moral hazard could be limited by backing up coverage, and imposing patient cost sharing. The British NHS in contrast kept care "free," but imposed supply-side limits, exactly as managed care plans do in the U.S. today.

I believe that, even now, this alternative public-choice formulation is highly valuable. First of all, for health insurance, it is clear that the reason for setting up the NHS (as for Medicare and Medicaid after it) was not some kind of market failure in the middle class private insurance market. Rather, the motivation was that the absence of insurance provided an inhibition to the use of highly beneficial but unaffordable care, especially by lower income persons. Perhaps more importantly, Buchanan's treatment emphasizes the nature of insurance as a collective activity—a voluntary pooling of risk by people who are willing to promise a fixed contribution ex ante in order to make large transfers to the unlucky ex post. The treatment emphasizes that the insurance-induced increase in the use of services is not necessarily undesirable—it may satisfy altruistic desires, and it may be an unavoidable side effect of risk protection. The problem arises when the protection, or the insurance coverage, is carried too far.

The monograph does leave unexplained why the NHS has so steadfastly resisted patient cost sharing to control use, relying instead on budgetary limits (and now physician "fundholder" payments) which often ration through wasteful waiting time. Ideology, and perhaps source notion of equity, might be responsible. However, especially as the U.S. system itself moved to privately chosen, supply-side rationed managed care, readers of Buchanan's study should not have been surprised to see a backlash at the inconsistencies of those systems developed here as well.

Is Medical Care a Necessity?

The second paper, titled "Technological determinism despite the reality of scarcity: a neglected element in the theory of spending for medical and health care," was presented at a conference on "Health Care for an Aging Population" held in 1989 in, of all places, Little Rock, Arkansas. The irony is not only that the then –governor in residence in Little Rock and his wife would become notorious for their health plan four years later, but also that some of the themes Buchanan sounds in his article were to feature in that debate. The paper is about "technological determinism" in health care—what Victor Fuchs has labeled the technological imperative—the idea that new beneficial medical technology, exogenously generated in bioscience labs and academic medical centers—will be acquired by medical care consensus no matter what the price. (Fuchs has subsequently recanted on this issue, however.) Buchanan apparently accepts this hypothesis, and the consequent "obscene" rate of growth in real medical care spending it seemed to imply. This paper poses two questions: why do individuals behave like this? and should there be some collective actions to limit this individual behavior? One answer that Buchanan gives is that "perhaps, just perhaps" there are "lexicographic preferences." The other is that there may perhaps be a reason to limit collective choices made by individuals. The latter answer, to be sure, is conflicting, since it seems to override his (and our) natural preferences for accepting free market outcomes as in individuals’ own best interests.

The notion of lexicographic preferences is simple: Buchanan hypothesizes that people decide to satisfy their preferences for medical services first, and then decide how to spend the rest of their income. The rationale for this assumption is the observation that a person cannot go without care for a broken arm.

If people do "put medical care first" in this fashion, and if the cost of medical services rises continuously because of technological change, should the resulting "inflationary" outcome be accepted? Or is there both (a) a basis for overriding it through collective choice and (b) a high probability that the choice would be overridden? In the ironic twist noted earlier, one of the features of the Clinton plan which its opponents found most objectionable was a pre-set limit on the rate of growth of total health spending in the United States, tied to the rate of growth of GDP.

What does hindsight and health economic research say about this theory? The most obvious (and surprising) empirical fact is that, just at about the time the conference volume was published, the seemingly inexorable high rate of increase in real health spending dropped, most especially in the private sector. The real rate of growth of private health spending per capita fell from about 6 percent in the period 1980-1990 to about 2.5 percent in the period from 1993-1998. This behavior confirmed an aphorism of another Virginia economist, Herb Stein: If it can’t go on forever like this, it won’t."

It appears, however, that the slowdown in spending growth did not come from slackening the pace of technical change; rather, growth slowed because managed care insurers negotiated discounts on doctor fees and hospital charges, and cut the rate of use of hospitals. The growth rate now seems to be picking up a little, while some think that the rate of technical changes has slowed a bit, but the final returns are not it yet.

What is clear is that there has been a changed in the organization of insurance which should permit more precise limitation of technical change. Rather than options only of Blue Cross or commercial indemnity plan, many consumers can now choose from a variety of managed care plans of varying degrees of strictness, including strictness about adoption and diffusion of new technology. As long as legislators do not put barriers in the way, consumers who do not want to pay for some costly new technology should be able to find a health plan that puts the managerial controls in place to limit the technology, and transfers the savings to lower premiums. If there is a technological imperative, the tools now exist to resist it. Buchanan gives the example of a new $420,000 miraculous treatment for a broken arm that would "cure" in one day. In the current environment, this would be reflected in a choice between two managed care plans, one with a $2000 normal premium and slow recovery, and the other with a $2420 premium and instant recovery from a one in 1000 chance of a broken arm. I do not imagine that everyone would prefer the latter insurance, and there are some private insurers who are strict on approving new technology.

There are two more fundamental ideas in Buchanan’s article that I wish to discuss: the notion of lexicographic preferences for medical care, and the possibility that citizen-consumers might choose to override collectively the rate of technical change they had chosen individually.

The idea that some medical services come before all others in a person’s consumption planning--the treatment that will save your life with probability near one (the heart transplant) or will relieve intense pain or dysfunction (setting a broken arm)--surely fit into this category. We now know that much, perhaps most, of medical services do not fit this characterization. The definitive evidence is from a social experiment, run by the Rand Corporation, in which some people were bribed into accepting catastrophic (but still decent) insurance coverage and others were offered free care. The former spent 46 percent less than the latter, hardly behavior consistent with consumer beliefs that all or most care is "necessary."

To be sure, there is a concept of "medical necessity" which is alleged to be meaningful to physicians and plaintiff’s lawyers. I studied this concept some years ago, and concluded that it either meant "all care of positive net benefit, no matter how miniscule" (which even physicians, if not lawyers, reject on common-sense grounds), or it meant nothing at all. The topic has arisen again in the current debate about regulating managed care plans; a requirement for all medically necessary care to be covered appears likely to be rejected, based in part on inevitable physician conflict-of-interest in defining medically unnecessary care, and in part based on the imprecision associated with the observation "all doctors can agree that a third of care is unnecessary; they just can’t agree on which third."

If, upon examination, there is not much substance to the general notion of lexicographic preferences or "necessary care," why does it nevertheless seem to be a perennial and popular notion? Part of the reason is that needy people would like to believe that their doctor knows what care is necessary and what is not, despite overwhelming evidence of physician ignorance and subsequent variation in treatment patterns for a given illness. Part is the related points that people feel decidedly uncomfortable admitting that they trade off health against money like any other good. Behind the wheel late at night, when I have put my own life and that of my family at risk by driving rather than flying to Grandma’s house just to save on airfares, I may admit to a tradeoff—but I am unlikely to do so in polite company.

There is another explanation for this feeling of the irresistibility of technology that I believe may explain part of what Buchanan was trying to get at. James Baumgardner has pointed out that much of technical change or medical services differs from that in other products. For those products, as Buchanan (and Baumgardner) note, improvements in technology can be modeled as a fall in effect price, fully consistent with the conventional economic model. Baumgardner hypothesizes, however, that sometimes things are different in medical care.

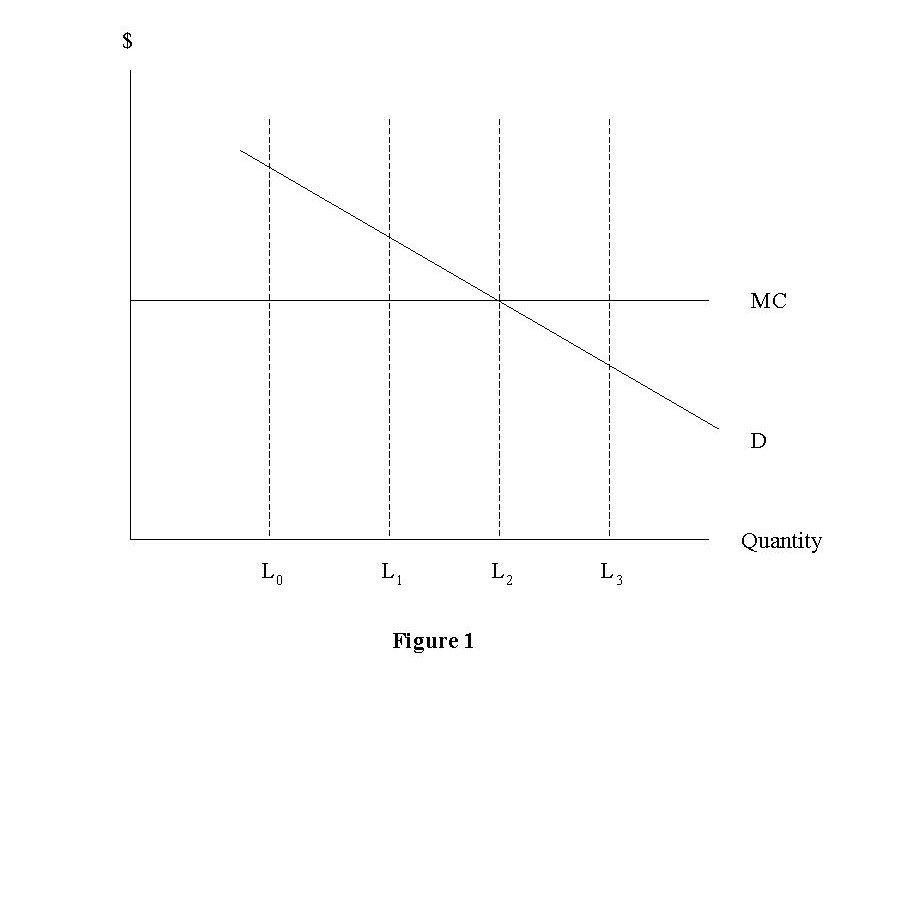

Imagine that the demand curve or marginal valuation curve for "health" (expressed as additional years of survivals) for a person with a serious illness is D in Figure 1. Medical care providers can treat this person, providing additional units of health at an assumed constant marginal cost of $MC. However, in some cases, it may be reasonable to assume that, with current technology, there is a limit such as L0 to what science can do. At this point, the person’s marginal value of additional health is still very high relative to MC, but no additional effective treatment exists.

Baumgardner represent what he calls "boundary shifting" technology by a movement of the limit from L0 to L1. To the person with the demand curve D, this new technology will appear "necessary," "imperative," or placed before all other items of consumption. At this margin, the consumer will not have adjusted; technology changes price, but the reduction from infinity to MC is so large as to be qualitatively different from other consumption decisions.

If biomedical science continues to supply boundary-shifting technologies, medical spending will rise. Of course, some technologies will (or ought to) be rejected (such as those that cause a shift from L2 to L3). But, at least at the present in this imperfect world, there are still illnesses causing premature death for which new technology, despite the costs, is desirable.

The key issue here is the source and validity of the demand curve D. If it is taken as appropriate (or inevitable), technology which shifts high value boundaries will be adopted. Moreover, people will prefer their insurance to cover it, rather than bear the risk of an out-of-pocket expense. So any challenge to the market-determined rate of technical change must challenge the validity of the demand or marginal valuation curve.

Buchanan suggests one intriguing possible challenge—that people, behind an intergenerational veil of ignorance—might not wish to accept the resource allocation discussions made myopically by each generation. I want to speculate here—and emphasize the word "speculate"—that these might be some reason to challenge these decisions. I consider two reasons: impatience and imperfections in intergenerational transfers.

The impatience idea proceeds from a characterization of new technologies offered by the physician-author Lewis Thomas: that many new technologies are "halfway technologies." They increase in the quantity or quality of life not by preventing or curing, but by palliating, repairing, or ameliorating. The iron lung relative to polio vaccine, and mastectomy or prostatectomy relative to a cancer cure, are examples of such technologies.

When such a technology is introduced into a situation in which previously there was no hope whatsoever, people might prefer to use it immediately rather than wait for the better, and less expensive, alternative. With perfect foresight, this would not happen, but perfect foresight may not always be present. Collectively, however, people might choose to delay the introduction of soon-to-be-obsolete technology.

The other possibility for collective (even constitutional) intervention occurs in a model of multiple generations with productive capital. Total (discounted) consumption might require transfers from one generation to the next. However, a member of the first generation, confronted with the choice between accepting certain death and making a transfer to the next generation versus spending whatever wealth presently available on costly technology with a positive but small chance of extending life may select the latter, especially if there is little concern for heirs and the generations do not overlap much.

Behind a veil of ignorance, an agent who could be a member of any generation might favor banning such extravagances. However, there is nothing special about spending on medical care, as opposed to other "splurges" like a round-the-world cruise. People may think that, if you can’t take it with you, you should try not to leave anything behind, but such behavior might in principle be rejected in the constitutional calculus. Still, there is no special reason to pick on medical technology—indeed the rate of growth of spending in the last year of life has lagged total spending, and is largely controlled by the collectively chosen Medicare program. Finally, both the presence of concern for heirs and the political difficulty of supporting, in the short term, the constitutional limits just described, weaken this argument.

Conclusion.

Because of the uncertain onset of illness, medical services are an appropriate candidate for insurance. But insurances (of all types, not just medical insurance) raise issues of conflict between the group-organized utility-increasing insurance, in which losers are compensated by winners, and individual insureds’ desires to make money off their insurance, whether or not they initially suffered a loss. If it is possible to change one’s behavior to increase the insurance pay off, that is, if moral hazard is possible, this conflict is exacerbated.

Buchanan’s emphasis on choice of rules before the game is played is an apt metaphor for insurance (as for many things in life) and has enriched our understanding of the fundamental concepts of health insurance. His formulation of insurance as ultimately a collective risk pooling/risk management effort, rather than an individualized purchase, is illuminating. Even his late 80’s worries about excessive growth in medical services spending, though currently less pressing, raise some fundamental questions about the roles of individual and collective decision-making in the longest of all runs.

Notes

1

Buchanan, James M. "Technological determinism despite the reality of scarcity: a neglected element in the theory of spending for medical and health care." Hackler, Chris, ed. Health Care for an Again Population. Albany, NY: State University of New York Press, 1994: 57-68.